stamp duty gst code

Share or bond certificates and similar documents of titleother than Duty Credit Scrips 6. The stamp duty must be paid no later than 14 days after.

What Is The Taxable Value Of Supply Under Gst Quickbooks

Gst Rate On Real Estate Or Under Construction Property Purchase 2020 Basunivesh.

. GST State Code List of India. HS Code GoodsService discription SGST CGST IGST CESS Conditions. Having said that you could use FRE as a code as FRE could be used.

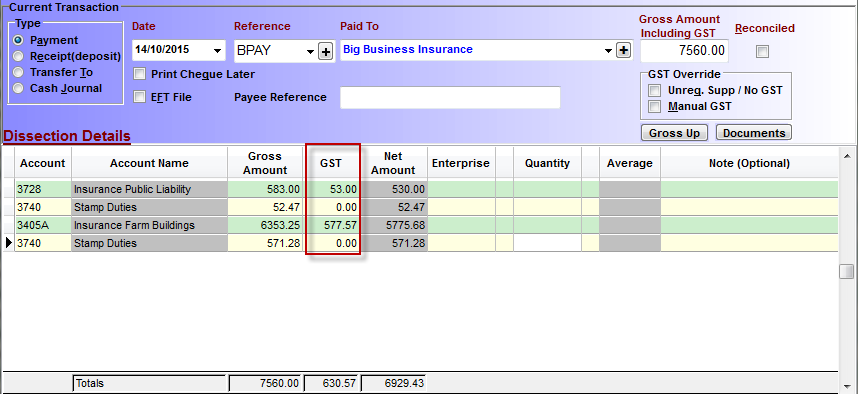

The fee has been reduced from 5 to 3. GST Code total amount of invoice as GST and manually override GST dollar amount to reflect GST shown on the invoice. What Is The Stamp Duty Applicable On Resale Flats.

Each software tends to use its own codes which doesnt help. The Lease Agreement between the Applicant ie. Singapore Budget 2018 Gst To Be Raised From 7 To 9 Some Time Between 2021 And 2025 Singapore News Top Stories The Straits Times.

SAC is mandatory for all firm who have turnover. GST on Income GST Free Income GST on Expenses GST on Capital GST on Capital Imports GST Free Expenses GST Free Capital Input Taxed BAS Excluded. If the Stamp Duty relates to a capital purchase normally it is capitalised with the associated asset ie.

Invoice for insurance premium is total 345. Transfers of property such as a business real estate or. Only claim GST dollar amount on invoice.

Yes stamp duty can be claimed as a tax deduction under Section 80C of the Income Tax Act up to a maximum limit of Rs. So it will include the Premium with GST to the expense item Insurance the stamp duty with the FRE tax code to the expense Insurance and the finance fee assuming it is interest without GST to the expense account Interest Tax code FRE. Approved Trader Scheme ATMS Scheme.

GST credits are not claimable on the following components which are not subject to GST. What Are the GST Codes Terms. While migrating to a GST registration or while going for a new registration most businesses would have received the 15 digit provisional ID or GSTIN Goods and Services Tax Identification Number.

What stamp duty applies to. BSD ABSD and SSD whichever applicable will be payable on the Declaration of Trust Trust Deed. Goods Services Tax GST Charging GST Output Tax When is GST not charged.

Is ruled by the Income Tax Act ITA the Economic Expansion Incentives Act EEIA the Goods and Services Tax GST Act and the Stamp Duties Act. 1B GST on purchases. Services by way of job work in relation to- a printing of all goods falling under Chapter 48 or 49 which attract GST 5 percent.

So far stamp duty and GST are separate charges levied on the sale of a property and as such have no impact on each other. Unused postage revenue or similar stamps of current or new issue in the country in which they have or will have a recognised face value. Wine of fresh grapes including fortified wines.

AAR Rulings Advance Ruling goods and services tax GST. Here is a list of GST codes and terms that comply with the Australian BAS. The lessor and the Lessee for a period of 99 years is a Lease Agreement of immovable property classifiable under HSN 9972 and attracts GST 18 SGST 9 CGST 9.

When the turnover of the firm is less than 15 crore it is not mandatory to use the HSNSAC code but they must mention the descriptiondetails of the Goods and Services offered in the invoice. Why Register for GST. Is stamp duty refundable.

Imports under special scheme with no GST incurred eg. Real Estate Motor Vehicle Etc. Stamp duty on motor vehicle insurance.

Normally 10 GST would apply to the total invoice value but in this case GST does not apply to the Stamp Duty portion so the GST is 28825 x 10 2883. Here are two examples. Government of Karnataka reduces registration stamp duty for low-cost apartments.

NTR GST CAP EXP FRE ITS INP GNR. Stock share or bond certificates and similar documents of title. So yes I am trying to reduce the GST to less than 10 of the total invoice value.

Grape must other than that of heading 2009. Knowing the structure of the GSTIN is crucial for a business - to ensure that ones suppliers have quoted the. Youll need to pay stamp duty for things like.

A fixed duty of 10 is payable on the Declaration of TrustTrust deed which does not result in a change in beneficial interest in the property. Gst code stamp duty Income Tax Goods and services Tax GST Service Tax Central Excise Custom Wealth Tax Foreign Exchange Management FEMA Delhi Value Added. In this article we describe briefly the tax code in Singapore.

Stamp duty is tax that state and territory governments charge for certain documents and transactions. GST HS Code and rates for stamps HS Code GST rate find tax rate. Components are Premium 28825 Stamp Duty 2792 GST 2883.

No stamp duty is not refundable. Does stamp duty include GST. Registering for GST while youre below the threshold is a somewhat common occurrence among small business owners.

Where there is a change in beneficial interest in the property full stamp duty ie. Or Nil b all food and food products falling under Chapters 1 to 22 in the First Schedule to the Customs Tariff Act 1975 51 of 1975. Capital acquisition GST item.

This reduction in stamp duty in West Bengal is applicable on property registration from July 2021 till December 2021. Similarly buyers purchasing a property in rural areas have to pay 3 stamp duty now as against 5 earlier. Under GST HSN code is used to classify the goods while SAC code is used to classify different services.

The main provisions of the Singapore Income Tax Law. In case the worth of the property is over Rs 1 crore the buyer will have to pay an additional 1 stamp duty. Stock share or bond certificates and similar documents of titleother than Duty Credit Scrips.

Grosss Premium 151715 plus 12 fee 18106 169921 12 months. GST on purchases directly attributable to taxable supplies. Judicial Non-judicial stamp papers Court fee stamps when sold by the Government Treasuries or Vendors authorized by the.

C all products falling under Chapter 23 in the First Schedule to the. Mof Goods And Services Tax. GST on import of goods.

The Karnataka Cabinet have made a decision to reduce the stamp duty on registration of apartments which cost between Rs35 lakh and Rs45 lakh. Search HSN code for Stamp Duty in India. Unused postage revenue or similar stamps of current or new issue in the country in which they have or will have a recognised face value.

You could use a GST code Capital Acquisition - No GST. You may need to create this in Tax Codes as a new tax code with 0 as the rate. Motor vehicle registration and transfers.

Conveyance Deed Explained Hindi Conveyance Deed Kya Hoti Hai Aur Kis Tarah Ke Property Rights Transfer Hote Hai Finance Buying Property Videos Tutorial

Gst State Code List And Jurisdiction 2022

Gst Registration A Game Changer For Most Of The Industries

Gst Goods And Services Tax Meaning Full Form Types Housing News

The Correct Tax Rate And Account Code For Imports And Duty

What Next For Gst The Financial Express

Export Basmati Rice Basmati Rice Basmati Indian Rice Basmati

Gst Free And Non Reportable Ps Support

Floor Plan Raunak Supreme Code Liv Large Floor Plans Large Floor Plans How To Plan

Gst Change Of Address A Quick And Easy Online Process Ebizfiling

How To Calculate Gst On Under Construction Property With Examples Tata Capital Blog

Gst On Real Estate 5 On Under Construction 1 On Affordable Housing

Lodha Gardenia Residences Mumbai Ad Toi Mumbai 10 10 2020 Real Estates Design Real Estate Brochures Property Ad

Kbc Helpline Whatsapp Number 9313473098 Online Customer Service Customer Service Customer Care

Pin By The Taxtalk On Income Tax In 2021 Memes Coding Income Tax

No comments for "stamp duty gst code"

Post a Comment